If you’re a high-income earner with multiple employers, you may unintentionally exceed the super concessional contributions cap in any year, causing you to be liable for tax on your excess concessional contributions. To remedy this, laws have recently been passed to allow you to opt-out of super guarantee from some of your employers.

The reason for introducing the legislation

Under the superannuation guarantee framework, employers are required to contribute a minimum percentage (currently 9.5%) of their employee’s ordinary time earnings into superannuation. Employers that fail to do so are liable for superannuation guarantee charge. If you’re a high-income earner with multiple employers, this requirement may inadvertently cause the total of your super guarantee contributions over the concessional contributions cap, which is currently $25,000.

If you exceed your concessional contributions cap, the excess over the cap is treated as additional assessable income in your tax return and you will pay tax on it at your marginal tax rate, less a offset of 15% (for the contributions tax already paid by your superfund). You are also liable for the Excess Concessional Contributions Charge (a notional interest amount paid to the ATO) and the portion of excess contributions not released from your superfund count towards your non-concessional contributions cap for the relevant year, which can potentially cause an excess non-concessional cap issue.

In short, prior to the opt-out, there was no way to prevent the super guarantee requirements from causing high-income earners with multiple employers to exceed the concessional contributions cap.

The effect of the change

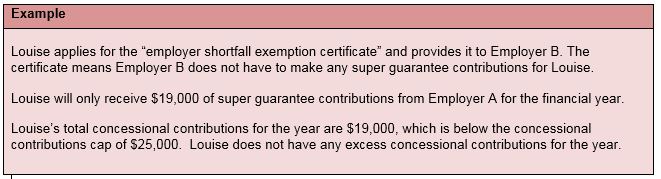

To avoid this unintended consequence, laws have recently been passed so that eligible high-income earners with multiple employers can partially opt-out of the super guarantee requirements. From 1 January 2020, employees with more than one employer who expect their combined employers’ contributions to exceed the concessional contributions cap can apply for an “employer shortfall exemption certificate” with the ATO.

The certificate will release one or more of your employers from their super guarantee obligations for up to four quarters in one financial year. However, you must still receive super guarantee contributions from at least one of your employers for the year. From the employer’s perspective, the certificate means that it will not be liable for the super guarantee charge or other consequences if they don’t make super guarantee contributions for you for the time period covered.

However, it is essential to consider the impact of utilising the exemption on your overall remuneration package. If you opt out of super guarantee with one or more employers, you may prevent exceeding the cap, but you will also be forgoing the financial benefit of the actual contributions. Therefore, you should negotiate with your employer with regards to how the forgone super amount can be factored into your salary such that your overall remuneration package remains unchanged.

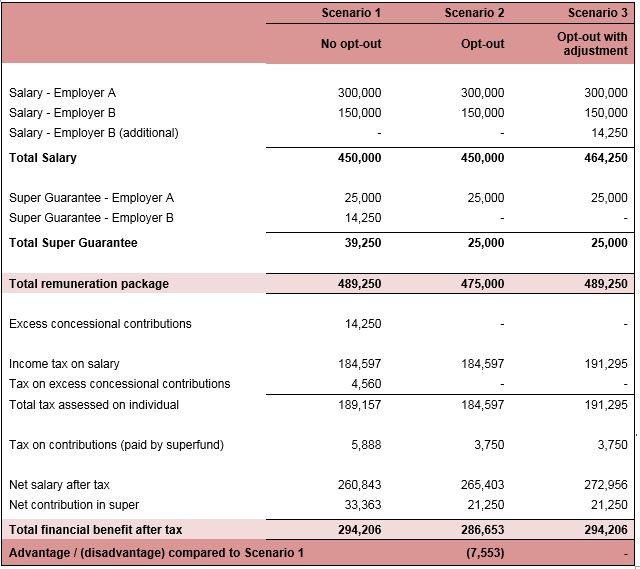

Below is an example comparing the net result for an employee under three possible scenarios *:

- Scenario 1 – No opt-out

- Scenario 2 – The employee has opted out of super guarantee with Employer B but has not re-negotiated their remuneration package.

- Scenario 3 – The employee has opted out of super guarantee with Employer B and has re-negotiated their remuneration package.

* This example is based on 2020 FY rates and assumes the employee has no other income or deductions. Excess concessional contributions charge would apply in Scenario 1, but has not been calculated for the purposes of this example.

As you can see from the above, after all taxes have been accounted for, in Scenarios 1 and 3 the employee ends up with the same net financial benefit. This is because the amount of tax paid on the remuneration package stays the same overall. However, in Scenario 1 a larger portion of the net financial benefit is held in super.

Conversely, in Scenario 2 the employee receives a substantially lower overall financial benefit as their forgone super contributions have not been replaced.

Further, where an employee would normally exceed the concessional contributions cap but opts out such that their total concessional contributions fall below the concessional cap, their net financial benefit will (all other things being equal) actually reduce by opting out.

Below, we consider the benefits of opting out and not opting out.

| Benefits of opting out (where forgone super is replaced by additional salary) | Benefits of not opting-out |

|

|

There are multiple factors that need to be considered in deciding whether or not to opt out. The above are indicators only and a decision should be made in light of your specific circumstances and in consultation with your accountant and/or financial advisor.

Who does it affect?

This change is only relevant if you have:

- more than one employer; and

- total salary (from all employers) of $263,157 or more (excluding super) for the year (based on the current concessional contributions cap of $25,000 and super guarantee rate of 9.5%).

If you only have one employer, there is already legislation in place to limit the amount of super guarantee contributions that your employer is required to make. Employers are only required to pay super guarantee on earnings up to the “maximum contribution base”. For example, the maximum contributions base for the 2019-20 income year is $55,270 per quarter ($221,080 per annum). Where an employee earns more than $221,080 in the year, the employer is only required to make super guarantee contributions of $21,002.60 (9.5% of $221,080), which is less than the concessional contributions cap.

When you need to apply

Applications for the certificate must be lodged with the ATO at least 60 days before the first day of the first quarter the application relates to. For example, if you want the certificate to apply the first quarter commencing 1 July 2020, you will need to lodge a form with the ATO on or before 1 May 2020.

The due dates for lodgement of the certificate application for the quarters commencing 1 January 2020 and 1 April 2020 have now passed, however you can still apply for the exemptions for future quarters (ie. for 1 July 2020 onwards).

An exemption certificate can be for a period of up to four quarters in one financial year. A separate application is required for each new financial year.

Only the employee is able to apply for the certificate. It cannot be applied for by the employer on the employee’s behalf.

What you should do before applying

Before you apply, the first thing you should do is to ascertain the impact on your net position based on your personal circumstances. Your accountant can be of great use here to assist with accurate modelling to quantify the impact.

Then, it is essential to discuss the matter with your employer(s), to ensure they understand what the exemption means, what action they will need to take once they receive the certificate, and to negotiate any changes to your remuneration package as relevant.

Once you have come to an agreement with your employers, it is important to get the details right as the certificate cannot be varied or revoked once its issued. Whilst this provides certainly to the employer that the exemption cannot later be withdrawn to their disadvantage, it also means that the choice of employer and/or the period that the certificate apply to cannot be changed, even if you have made a mistake and the mistake causes you a disadvantage.

We’ll help you get it right

Are you unsure about whether you’ll be over your concessional contributions cap? Perhaps you’d like to understand how opting out of super guarantee will affect your other entitlements? Or maybe you’ve spoken to your employers and would like to apply for an exemption certificate? We can help you with all this and more – Contact us today.

Sorry, comments are closed for this post.