Unpaid (and under-paid) employer superannuation has been an ongoing and pervasive issue ever since the introduction of superannuation guarantee on 1 July 1992. While historically the Australian Taxation Office (ATO) has had to rely on employees reporting instances of unpaid super and analysis of tax return data to identify non-compliant employers, there has been a dramatic increase in the availability of data to the ATO over recent years via data matching and, more recently, Single Touch Payroll (STP) reporting. This access to data is empowering the ATO in its mission to crack down on employers who fail to meet their superannuation guarantee obligations.

Unpaid (and under-paid) employer superannuation has been an ongoing and pervasive issue ever since the introduction of superannuation guarantee on 1 July 1992. While historically the Australian Taxation Office (ATO) has had to rely on employees reporting instances of unpaid super and analysis of tax return data to identify non-compliant employers, there has been a dramatic increase in the availability of data to the ATO over recent years via data matching and, more recently, Single Touch Payroll (STP) reporting. This access to data is empowering the ATO in its mission to crack down on employers who fail to meet their superannuation guarantee obligations.

But what about unpaid super owing from periods prior to this?

In order to encourage employers to pay super already owing, the Government announced a one-off Superannuation Guarantee Amnesty, which would give employers the opportunity to make disclosures and pay outstanding super obligations while avoiding the normal super guarantee penalties.

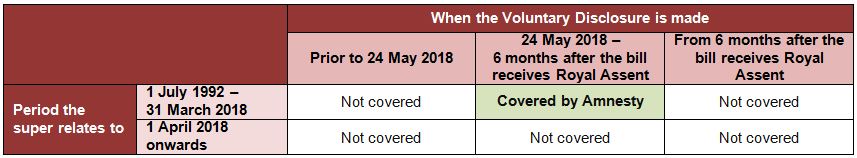

The amnesty was originally announced by the Government on 24 May 2018 to take effect until 23 May 2019, however the original Bill lapsed when Parliament was prorogued for the 2019 Federal Election. The bill was re-introduced into Parliament on 18 September 2019.

Existing Superannuation Guarantee law

In order to appreciate the significance of the amnesty, it is important to understand how the superannuation guarantee legislation works normally. Below is a summary.

- Employers are required under the Superannuation Guarantee (Administration) Act 1992 to pay minimum superannuation contributions for their employees. The superannuation amount is calculated as a percentage (currently 9.5%) of the employee’s ordinary time earnings.

- Superannuation guarantee payments are required to be paid by the 28th day of the month following the end of the quarter to which they relate.

- There are two main consequences of failing to pay superannuation guarantee on time: The employer is required to submit a Superannuation Guarantee Charge (“SGC”) Statement to the ATO and pay Superannuation Guarantee Charge and superannuation guarantee amounts not paid by the due date are not deductible for income tax purposes (even if they are paid at a later date or SGC is paid).

- The Superannuation Guarantee Charge (“SGC”) consists of three components:

- The Superannuation Guarantee Shortfall – This is calculated as a percentage (currently 9.5%) of the employee’s salary and wages (as opposed to the normal superannuation guarantee amount which is calculated only on ordinary time earnings).

- A nominal interest component – Interest charged (currently 10%) on the unpaid super from the start of the quarter the super relates to until the time the SGC is paid.

- An administration fee – Currently $20 per employee, per quarter.

If super has been paid, but was paid after the due date, the employer may elect for this to offset the SGC.

- The SGC amount is paid to the ATO, which will then pay the Superannuation Guarantee Shortfall and nominal interest amounts to the employee’s superfund.

- The SGC statement is due one month after the date that the superannuation guarantee was due. If the SGC Statement is made late, general interest charge may apply on the SGC amount from the date the SGC statement was due until the date it is paid.

- The penalty for not lodging a SGC statement is up to 200% of the SGC amount payable. This is on top of the SGC amount.

Operation of the Amnesty under the proposed law

The bill currently before Parliament outlines the operation of the proposed amnesty. We have summarised the key features below.

Periods covered by the amnesty

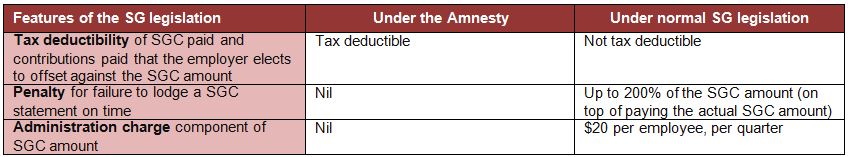

Benefits of disclosing during the amnesty

The table below compares the operation of the proposed amnesty legislation as compared to the operation of the normal Superannuation Guarantee legislation.

Under the amnesty, employers will also have the option to pay the SGC amount directly to their employees’ superfunds rather than to the ATO.

If an employer is unable to make the SGC payment in full, they may be able to enter into a payment arrangement with the ATO. However, if an employer does not enter into an arrangement and fails to pay on time, or if they fail to comply with the payment arrangement, the concessional treatment under the amnesty may be lost.

Note that the above benefits apply only to superannuation periods covered by the amnesty, and that are voluntarily disclosed to the ATO under the amnesty.

Eligibility for the amnesty

Employers are only eligible for the amnesty if they make a voluntary disclosure in the prescribed format. If the ATO has commenced a superannuation guarantee audit prior to the employer making the voluntary disclosure, the amnesty conditions will not apply.

The amnesty does not apply in relation to unpaid superannuation amounts already disclosed in the past, or amounts identified by the ATO.

What to do

It is important to note that the bill containing the proposed amnesty has not yet been passed by Parliament. Therefore, there are a few factors to consider when deciding whether to make a voluntary disclosure.

- If the bill is not passed, the protections against ATO penalties for disclosing businesses would not be guaranteed by law.

- However, even if the amnesty legislation is not passed by Parliament, it is reasonable to expect that the Commissioner may exercise his discretion to reduce penalties for employers who make voluntary disclosures during this period of uncertainty.

- Regardless of whether the amnesty is legislated, penalties of up to 200% of the SGC amount can be imposed if a non-compliant employer is caught by the ATO.

- If the amnesty is legislated, where employers do not come forward during the amnesty and are later caught out by the ATO, the ATO will be required by law to apply a minimum penalty of 100%. (Normally the Commissioner can exercise his discretion to reduce the penalty below 100%).

If you are unsure whether the proposed amnesty would apply to you, or how the operation of the amnesty will affect you, we strongly recommend you contact us to discuss your circumstances.

Sorry, comments are closed for this post.