ATO Draft Practical Compliance Guideline

The ATO has recently released Draft Practical Compliance Guide (“PCG”) 2022/D4 to assist taxpayers in complying with the laws relating to claiming a tax deduction for expenses incurred while working from home. The PCG includes a revised method of claiming working from home expenses from 1 July 2022 onwards.

Previous methods of home office expense deductions

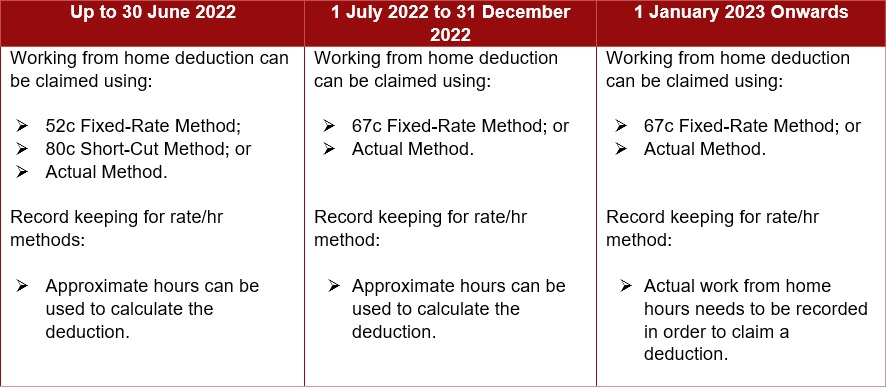

Prior to 1 July 2022 individuals had three methods they could use to calculate their tax deduction for running expenses incurred while working from home:

- Fixed-rate method (52c per hour);

- Short-cut method (80c per hour); or

- Actual Method.

Click here for an article that provides more details on these three methods.

Due to PCG 2022/D4, from 1 July 2022 onwards individual’s will only have two methods to calculate their tax deduction for running expenses incurred while working from home:

- Revised Fixed-rate method (67c per hour); or

- Actual method.

What is included in the revised fixed-rate method?

The revised fixed-rate method released in the PCG is 67c per hour for each hour you work from home during the income year and includes the following expenses:

- Energy expenses (electricity and/or gas);

- Internet expenses;

- Mobile and/or home telephone expenses; and

- Stationery and computer consumables.

If this method is chosen, you cannot claim an additional separate deduction for any of these expenses. For example, if you use your mobile phone when working from home and when you are working from your office, your total deduction for mobile phone expense will be included in the 67c per hour rate.

What is not included in the revised fixed-rate method?

If you choose to use the revised fixed-rate method, the decline in value of depreciating assets (e.g. a laptop or work desk) or any other running cost not outlined above can be claimed separately, provided that you have incurred the cost and it was incurred in producing your income while working from home.

First criterion – What is considered working from home?

The guideline sets out that to be considered working from home, you must be carrying out your employment duties or duties related to carrying on your business from your home, and these duties are substantive and directly related to producing your income. Therefore, minimal tasks like occasionally taking phone calls or checking emails are not considered as working from home.

Some examples include:

| ✓ | Your employer has set work from home days |

| ✓ | You work in the office 4 days per week and work from home 1 day per week |

| ✗ | Occasionally checking emails over the weekend |

| ✗ | Checking your roster before each work week starts |

| ✗ | Answering work calls when you get home from work |

Second criterion – Incurring deductible additional running expenses

To satisfy this criterion you must satisfy all of the following:

- Incur at least one additional running expense for a cost included in the revised fixed-rate method (you incur the expense when the amount is paid or an obligation to pay arises);

- You have not been reimbursed for the expense(s) by a third party such as your employer; and

- You have invoices or bills in your name or in the name of one member of the household, examples include:

- Family circumstances such as a husband and wife where only one is listed on the invoice;

- Two unrelated parties share accommodation but jointly contribute to expenses;

- This does not include where a child is paying board to their parents as these arrangements are generally private in nature.

EXAMPLE – Incurring additional running expenses

Pierre is working from home using his computer, his home internet connection, and his mobile phone. Pierre’s mobile phone bill is in his name so he has incurred the expense. However, his electricity bills are in his partner’s name and the internet bill is in his and his partner’s name. All of Pierre’s household expenditure is paid from a joint bank account, so Pierre is considered to have incurred the electricity and internet expenses as well.

EXAMPLE – Not incurring additional running expenses

Sergei works from home two day per week. Sergei lives with his parents and when he works from home, he works in his bedroom using his employer-provided laptop and mobile phone. Sergei does not pay his parents any rent and he does not contribute to any of the household bills.

Although Sergei is carrying out his employment duties while working from home, he is not incurring additional running expenses. Accordingly, Sergei is not entitled to a deduction for additional running expenses and he cannot rely on the ATO’s PCG.

Third criterion – Keeping and retaining relevant records

To satisfy this criterion you must keep the following records:

- Records that show the total number of hours worked from home during the financial year (An estimate for the entire income yearor an estimate based on the number of hours you work from home during a particular period and applied to the rest of the income year will not be accepted); and

- One document for each of the additional running expenses that you’ve incurred during the income year, such as invoices, bills, or a credit card/bank statement.

For the 2022-23 income year only, you need to keep a record of the following:

- Approximate total number of hours worked from home for the period 1 July 2022 to 31 December 2022; and

- Actual total number of hours worked from home for the period 1 January 2023 to 30 June 2023.

What is and isn’t accepted as a record of actual hours worked from home from 1 January 2023 onwards:

| ✓ | Timesheets |

| ✓ | Rosters |

| ✓ | A diary or similar document kept contemporaneously |

| ✗ | An estimate of the number of hours |

EXAMPLE – Keeping and retaining relevant records

Pamela is employed as a solicitor. She works from home some evenings or on the weekend, in order to meet deadlines. The number of hours Pamela works from home varies from week to week.

During the income year, Pamela keeps a record of the total number of hours she spends working from home. She does this by making an entry in her electronic calendar when she starts and finishes working from home on a particular day.

When she is working from home during the income year, Pamela incurs electricity and internet expenses.

To show she has incurred additional running expenses, Pamela keeps:

- one quarterly electricity bill; and

- one monthly invoice for her home internet

Relevant Dates

What to do next

- Determine if you are eligible to claim a working from home deduction.

- From 1 January 2023 start keeping a record of the hours you work from home. We have created a template for you to use. Please click here for a copy of the template.

- From 1 January 2023 start keeping a record of one eligible invoice / bill, per income year, for each expense incurred while working from home.

- If you have unusual circumstances, please contact your tax agent to discuss them.

This PCG has been released by the ATO in draft form. The final PCG may differ from the draft guidelines that have been released in PCG 2022/D4.

Sorry, comments are closed for this post.