|

When it comes to raising finance for a business, there are many options available, each with their own costs and advantages. Choosing the right type of finance requires keen consideration of your business and personal circumstances to ensure you can achieve the right result without adverse consequences. All forms of finance can be classified into two over-arching categories:

Where finance is classified as debt, interest paid to the lender is an expense (which is generally deductible to the business). Conversely, where finance is classified as equity, amounts paid to equity-holders are a distribution of profits that represent a return on their investment. |

Traditional Finance Options

| Type | Description | Advantages | Disadvantages | |

| Issuing shares / units | Equity | The company / trust issues shares / units to investors in exchange for a cash investment.

|

|

|

| Trade creditors | Debt | Utilising the full credit terms offered by suppliers. |

|

|

| Credit cards | Debt | Credit cards provided by financial institutions or credit providers. |

|

|

| Bank overdraft | Debt | A bank account that can be drawn below zero, and up to an approved credit limit. Overdrafts are intended for funding day to day cash flow needs (i.e. working capital). |

|

|

| Line of Credit | Debt | Similar to an overdraft, but intended for longer-term use and generally with less expected fluctuation in the amount drawn. |

|

|

| Business loan from bank | Debt | Banks provide various loan products to businesses with varying terms, interest rates, fees and security. |

|

|

| Trade financing | Debt | An arrangement whereby the bank pays for the purchase of goods from your suppliers upfront and the business is required to repay the amount within a given timeframe. The intention is to fund purchases until the business has had time to transport the goods, sell them and receive payment from the customer. |

|

|

| Invoice financing | Debt | An arrangement whereby when you issue an invoice, the bank will pay you cash equal to a certain percentage of the invoice value upfront. When your customer pays you, that percentage gets paid directly to the bank and the remainder is released to you. |

|

|

| Hire purchase | Debt | A finance contract where an asset is purchased and ‘leased’ while the asset is paid off in instalments with interest. Ownership of the asset passes to the business only once the financed amount is fully repaid. |

|

|

| Chattel mortgage | Debt | A loan for purchase of an asset, secured over the relevant asset and paid. |

|

|

| Debtors factoring | Debt | An external entity buys the business’ outstanding debtors at a discount. The business receives the cash up front and the factoring company then chases up the debtors. |

|

|

| Loans from related parties | Debt | Where a share/unit-holder or other related party has excess cash and lends this to the business. |

|

|

Alternative Options

It can sometimes be difficult for a business to borrow from a bank, particularly where the business does not have a strong or extensive trading history or does not have assets against which to secure a loan. But all is not lost!

It is possible for a share/unit-holder to borrow money in their own name, secured against property that they own. The individual can then either:

- On-lend the money to the business – The individual on-lends the funds to the business and on-charges the interest which it is paying to the bank. The individual reports interest received from the business as assessable income, and receives a deduction for the interest paid to the bank. The net effect is that the business receives a deduction for the interest paid on the borrowed funds and there is no impact on the individual’s taxable income.

- Use the borrowed funds to acquire equity in the business – The business would issue equity equal to the value of funds borrowed by the individual and contributed into the business. As the individual has purchased an investment, with a view to receiving dividends or distributions as a return on their investment, the interest paid by the individual on the bank loan is deductible. The net effect is that the business receives the funds upfront, and the individual receives the tax deduction for interest paid on the loan.

Depending on the type of business, crowd funding may also be a viable option to raise small levels of finance for funding prototypes, innovative projects or getting a project off the ground. Two common crowd funding platforms that are available in Australia are Kickstarter (U.S. based) and Pozible (based in Melbourne).

There are also a wide range of government and industry grants and incentives available, such as the:

- Research & Development Tax Incentive;

- Accelerating Commercialisation Grant;

- Export Market Development Grant;

- Minimum Viable Product grant (NSW); and

- NSW Payroll Tax Jobs Action Plan Rebate (see our article above).

See www.business.gov.au/assistance for more Government-based grants and assistance packages.

Practical Tips

A few things to keep in mind:

- When a business borrows from a bank or other financial institution, they are subject to financial covenants. That is, the business must ensure it meets certain financial ratios and criteria to continue to be eligible for the funding. Failure to adhere to these covenants can result in withdrawal of funds and, if the business cannot acquire replacement funds from another source, this can have dire consequences on the business’ survival. Businesses subject to such lending criteria must be sure to keep on top of their financial records to ensure they continue to meet them.

- Borrowing against a personal asset to provide finance to your business can put your personal asset at risk if the business is unable to re-pay the loan.

- Tax consequences can arise when a private company lends money to a related party. Seek advice before entering into such an arrangement.

- If you have multiple business or investment entities in your family group, it is important to take out finance in the most appropriate entity.

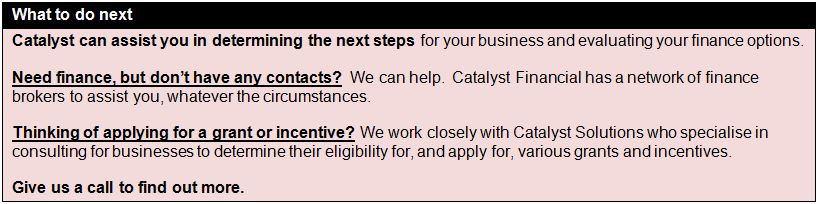

Business finance can be complicated and have long-reaching consequences, so it is important to have the right advice and guidance. We strongly recommend talking to your accountant before entering into a borrowing arrangement or issuing equity in your business.

Sorry, comments are closed for this post.