Investment properties are a class of investment that for many years has attracted all types of Australian investors. These investors have historically enjoyed significant capital growth whilst reducing their annual income tax by negative gearing their properties.

During the last 18 months, there has been a lot of attention on investment property negative gearing following The Australian Labour Party’s announcement that its policy is to limit negative gearing to newly constructed properties only.

This set the scene for some changes to negative gearing, which would positively impact the Federal Government’s budget. On 9 May 2017, Treasurer Scott Morrison delivered the Federal Government’s 2017-18 Budget and announced some changes which would impact on negative gearing for income years commencing on or after 1 July 2017.

We explore these changes below.

Travelling to Inspect your Investment Properties

Many property investors own properties where they either manage the properties themselves or own properties that are located in other states. Traditionally, these investors would incur car expenses to travel to their properties to inspect them, collect rent, and undertake maintenance. Investors with interstate properties would incur airfare and accommodation costs to travel to and inspect their investment properties.

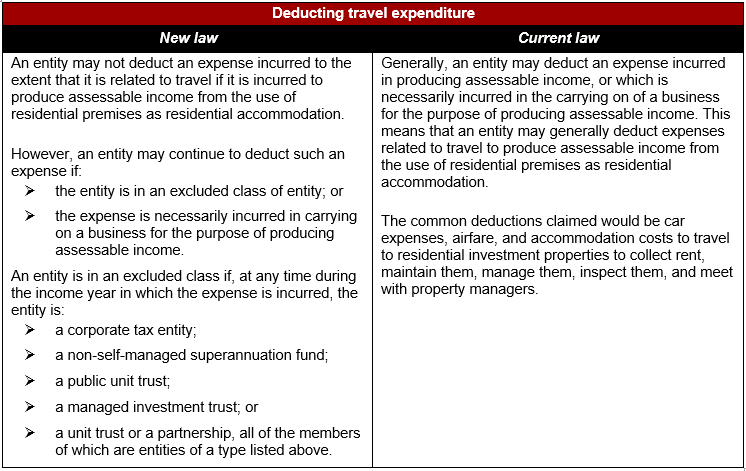

In the 2017-18 Budget, the government announced that it intends to deny all travel deductions relating to inspecting, maintaining, or collecting rent for a residential investment property from 1 July 2017. This would improve the integrity of the tax system by addressing concerns that some taxpayers have been claiming travel deductions without correctly apportioning them for private use. On 7 September 2017, the government introduced the legislation into Parliament.

The table below compares the current law to the new laws that have recently been introduced to Parliament:

Depreciation Deductions for Investment Properties

For many years, residential property investors have purchased investment property depreciation reports and claimed an income tax deduction for the decline in value (depreciation) of the assets within the properties. These assets are the furniture & equipment within a residential investment property and some common examples are air conditioning units, ceiling fans, floor coverings, hot water systems, lights, dishwashers, ovens & stoves, and clothes dryers. As depreciation is a write down of the value of an asset and not an actual cash expense, the tax saving generated from claiming a tax deduction for depreciation has always reduced the negative cash position of owning a negatively geared investment property.

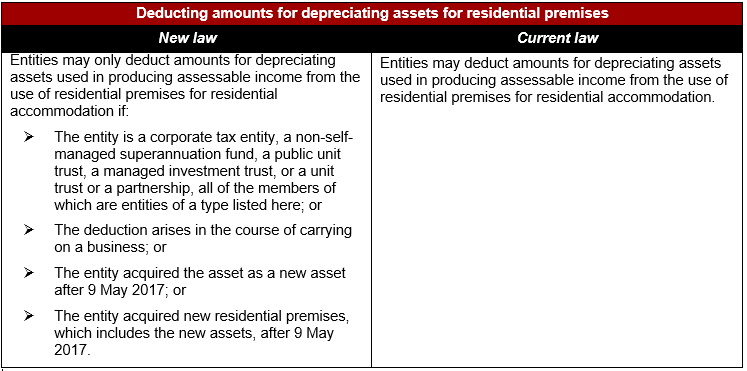

The second part of the legislation introduced into Parliament on 7 September 2017, amends the Income Tax Legislation to deny tax deductions for depreciation of previously used assets that an entity uses in producing assessable income from residential investment properties purchased after 9 May 2017. There is no change to depreciation deductions for residential investment properties acquired on or before 9 May 2017.

The table below compares the current law to the new laws that have recently been introduced to Parliament:

The above new law effectively means that:

- Residential property investors who purchase a second hand property after 9 May 2017, can only claim a tax deduction for new assets purchased after 9 May 2017 and not for the assets that existed in the property at the time of purchase; and

- Residential property investors, who purchase a new property after 9 May 2017, can claim a tax deduction for all the assets included in the property.

Vacancy Fees for Foreign Acquisitions of Residential Land

Under Australia’s foreign investment framework, the Government’s policy is to channel foreign investment into new dwellings as this creates additional jobs in the construction industry, helps support economic growth, increases government revenues, and increases Australia’s housing stock. Over the last few years, there has been a significant amount of foreign investment in new residential premises in Australia, however, on many occasions these properties are not occupied or genuinely available on the rental market – this negatively impacts on the government’s policy of increasing the number of properties available for Australians to live in.

The third part to the legislation introduced on 7 September 2017, seeks to reduce the number of unoccupied residential properties by imposing an annual vacancy fee on foreign owners of residential real estate where the property is not occupied or genuinely available on the rental market for at least six months in a 12 month period. This vacancy fee applies from 9 May 2017.

The main features of this new law are as follows:

- A vacancy fee is payable where a residential property has been occupied for fewer than 183 days in the relevant 12 month period;

- A foreign person must give the Commissioner of Taxation a ‘vacancy fee return’ in the approved form to advise of the number of days a residential property was occupied in a 12 month period (vacancy year);

- The Treasurer has the power to recover a vacancy fee if it remains unpaid, as a debt due to the Commonwealth in a court of a competent jurisdiction, or by notifiable instrument which declares a charge over the residential property;

- A civil penalty may apply where a foreign person fails to submit a ‘vacancy fee return’ or keep the required records.

Foreign Resident Capital Gains Withholding

In February 2016, legislation was enacted to require the buyer of a property to withhold tax from the purchase price where the property is purchased from a non-resident and the price is above the withholding threshold. In June 2017, further legislation was enacted to reduce the withholding threshold and increase the rate of withholding so that more transactions will fall within these rules.

These rules are intended to ensure that non-residents pay the appropriate amount of Australian tax on their gains on selling Australian taxable property.

The main features of these rules are:

- The withholding tax % is applied to the total purchase price of the property;

- The obligation to withhold is imposed on the purchaser of the property;

- The obligation arises when a buyer becomes the owner of a CGT asset it acquires from one or more entities where at least one of the entities is a foreign resident at the time of the transaction;

- The CGT asset is either taxable Australian real property, an indirect interest in Australian real property, an option or right to acquire such property or such an interest;

- The withholding tax rate is 12.5% of the purchase price and this rate applies to acquisitions occurring on or after 1 July 2017;

- The buyer is not required to withhold if the market value of the property purchased is less than $750,000;

- Vendors that are foreign residents may apply for a variation of the withholding rate i.e. if the tax withheld would be greater than the actual tax payable on the gain or if a loss is made from the sale of the property;

The purchaser is required to always treat the vendor as a foreign resident for withholding purposes unless the vendor provides a valid clearance certificate issued by the ATO.

Sorry, comments are closed for this post.