There is no doubt that COVID-19 has had a huge impact on just about every aspect of our lives. Many Australians have found themselves donning the newest fashion in work-attire and setting up instant home-offices. While there are already two existing methods for calculating the cost of working from home, the ATO has introduced an additional option specifically for the period in which taxpayers are working from home due to COVID-19.

Existing methods for calculating home office expenses

The two existing methods are the:

- Running cost method (actual method); and

- Cents per hour method.

See our September 2018 newsletter article Tax Deductions for Individuals, for more information on these methods and other deductions for individual taxpayers.

New COVID-19 home office expenses “Shortcut method”

The new method works the same way as the existing cents per hour method, however it is a higher rate that is all-inclusive (included costs are listed below). It is designed to simplify the process of claiming working from home expenses while so many of us worked from home due to COVID-19.

Using this method, you can claim 80 cents per hour, for each hour you work from home if:

- You are working from home to fulfill your employment duties (not just carrying out minimal tasks such as occasionally checking emails or taking calls); and

- You have actually incurred additional running expenses as a result of working from home.

Multiple people living in the same house can each claim using the Shortcut method, and you do not have to have a separate or dedicated area of your home set aside for working under this method.

The method is only available from 1 March 2020 to 30 June 2020, although it is possible the ATO will extend this beyond 30 June 2020 as working arrangements continue to be affected by the pandemic.

The existing two methods are still available to calculate your home office expenses. The new method is simply an additional option that can be used during the relevant period. Keep in mind you can only use one method for any given range of time (ie. you cannot claim the 80 cents per hour as well as the actual running costs method).

What costs are covered by the 80 cents per hour deduction?

If you use this method, the below costs are included in the 80 cents per hour deduction. You cannot claim a further deduction for any of the expenses listed below.

- Electricity for lighting, cooling or heating and running electronic items used for work (for example your computer), and gas heating expenses;

- Cleaning expenses;

- Decline in value and repair of capital items, such as home office furniture and furnishings;

- Decline in value of a computer, laptop or similar device;

- Phone costs, including the decline in value of the handset;

- Internet costs;

- Computer consumables, such as printer ink; and

- Stationery.

What records must be kept using this deduction method?

You must keep a record of the number of hours you have worked from home as a result of COVID-19. Examples are timesheets, diary notes or rosters.

What cannot be claimed while working from home due to COVID-19?

If you are working from home only due to COVID-19, you cannot claim:

- Occupancy expenses such as mortgage interest, rent and rates; or

- The cost of coffee, tea, milk and other general household items your employer may otherwise have provided you with at work.

Differences between the three methods

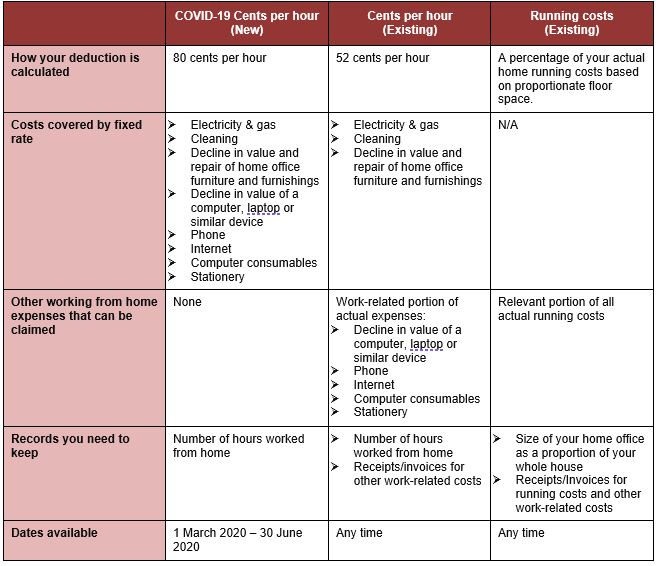

The table below compares the three home office deduction methods:

As always, occupancy costs (rent, mortgage interest, council rates etc) can only be claimed if the home office is a ‘place of business’. This generally doesn’t apply to employees.

What next?

If you worked from home due to COVID-19, maximise your home office expenses claim by:

- Selecting the most appropriate method for your circumstances;

- Ensuring you provide the relevant records as listed above to us when preparing your return;

- Contacting us if you need any assistance.

Sorry, comments are closed for this post.