The Capital Gain Tax (CGT) exemption we all love and know has been abolished for most individuals who are non-residents for tax purposes at the time they sell their home. The bill effecting the change received royal assent in December 2019, meaning the changes are now law.

The Capital Gain Tax (CGT) exemption we all love and know has been abolished for most individuals who are non-residents for tax purposes at the time they sell their home. The bill effecting the change received royal assent in December 2019, meaning the changes are now law.

Importantly, the changes have been applied retrospectively, with the date of effect being 9 May 2017 (subject to some transitional provisions). This means non-residents who have sold their main residence in Australia between 9 May 2017 and 30 June 2020 may need to review their previously lodged tax returns.

If you are a non-resident looking to sell your home in Australia, now is the time to seek advice to ensure you understand the tax consequences of selling your home before it is too late.

What has changed?

Generally, the main residence exemption operates such that no tax is paid on the portion of the capital gain that relates to the period during which the taxpayer treated the home as their main residence. The main residence exemption can also be extended for a period of up to six years after the taxpayer moved out of the property and used it for income producing purposes (or indefinitely if not used for income producing purposes) provided they do not take up another main residence. Where a home is the taxpayer’s main residence for only part of the ownership period, the exemption is applied proportionately to the capital gain, so at least a part-exemption still applies.

Prior to the changes, taxpayers who sold their main residence were eligible for the main residence exemption regardless of whether or not they were an Australian resident for tax purposes at the time of sale. This meant that, depending on their circumstances, taxpayers leaving Australia could potentially utilise the main residence exemption to treat part or all of the gain on sale of their home as exempt, even well after ceasing to be an Australian resident for tax purposes.

The change in legislation means that, subject to the exceptions explained below, capital gains made on the sale of a home in Australia will not be eligible for the main residence exemption at all if the sale is made at a time when the taxpayer is a non-resident.

The changes do not affect property sales by individuals who are Australian tax residents at the time of sale.

There are two exceptions to the new rules:

- the “six years certain life events exception”; and

- transitional provisions, which apply based on when the home was purchased.

The “six years certain life events exception”

If you have been a non-resident for a continuous period of six years or less when you sell your home and “certain life events” occurred during this period, you can still quality for the main residence exemption.

“Certain life events” are defined by the legislation and include the following:

- Taxpayer’s spouse or child under 18 had a terminal medical condition.

- Taxpayer’s spouse or child under 18 dies, or

- Divorce or separation (and asset distribution occurs).

Transitional provisions

Transitional provisions apply to provide relief to taxpayers who purchased their home prior to the announcement of the change on 9 May 2017, provided the sale occurs prior to 30 June 2020.

However, taxpayers who acquired their home after 9 May 2017 will not be eligible for the main residence exemption through the transitional provisions.

For non-resident taxpayers who acquired their home before 9 May 2017, the timing of selling their home could save or cost you tens of thousands of dollars in tax!

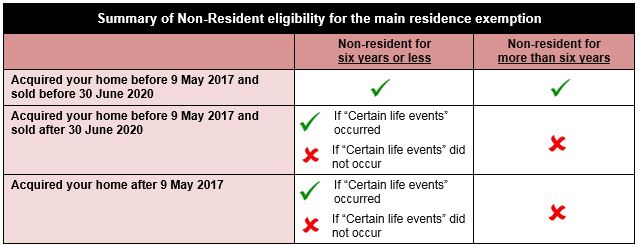

Below is a summary of the eligibility of non-resident taxpayers for the main residence exemption following the recent legislative changes.

What to do next

Due to the above changes, the timing of selling your home in Australia is pivotal for non-residents in determining the capital gains treatment of the sale, with a potentially huge impact on your CGT liability. It is important to understand the consequences of this sale before you sign a contract to ensure you are not hit with a sudden and unexpected tax bill.

| Your circumstances | Action required |

| You have sold your main residence in Australia since 9 May 2017 and you were a non-resident for tax purposes at the time of sale | If your home was purchased prior to 9 May 2017, no action is required.

If your home was purchased on or after 9 May 2017, consult your tax agent to determine whether any changes are required to your Australian tax return for the year when the property was sold. |

| You are currently a non-resident for tax purposes and intend to sell your main residence in Australia | Consult your tax agent urgently to discuss your plans and how the timing of the property sale will affect your eligibility for the exemption. |

| You are currently an Australian resident for tax purposes, planning to move overseas and you intend to sell your main residence in Australia | Consult your tax agent prior to moving overseas to discuss your plans and the timing of your sale. |

For more information, or to better understand how the changes in the main residence exemption for non-residents may apply to you, get in touch with our team at Catalyst Financial.

Sorry, comments are closed for this post.