Superannuation Guarantee (SG) plays an important role in the retirement plan of all Australians. It was first introduced on 1 July 1992 to increase the financial security of Australians once they retire with forced savings over a lifetime of working.

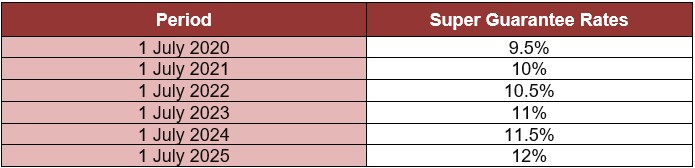

Currently, employers are required to pay a minimum of 9.5% on each eligible employee’s gross wages to the employee’s superannuation fund. However, from 1 July 2021, the SG rate will increase from 9.5% to 10% and then continue to increase until it reaches 12% on 1 July 2025. The table below illustrates the rate that applies from the start of each financial year.

Who is eligible for superannuation guarantee?

Generally, you are eligible for superannuation guarantee contributions if you are earning income as an employee, regardless of whether you are a full-time, part-time, or casual.

You are also typically eligible if you are:

- An employee under 18 years old, or a private or domestic workers, doing more than 30 hours of work per week.

- A contractor if you are paid mainly for your labour, even though you are working under your own ABN.

- An older employee, who might have already begun accessing some of their super.

What do you need to do as an employer?

In preparation for the change in the SG rate, there are a series of important considerations and reviews that should be undertaken by employers.

- Review your employment contracts and have clear communication with your employees about the following:

- If the employees’ salaries are paid as a package with superannuation inclusive, the SG rate change will reduce their gross salaries and take home pay.

- If the employees are paid a base salary plus superannuation, the SG rate change will increase their total salary package.

- You should be prepared for the additional superannuation liability:

- Consider updating the business cash flow or budget for the new financial year if one is in place.

- Make sure that the SG payment amounts that are accrued in your payroll system are reflective of the increase in the SG rate.

- Seek advice from your tax agent if necessary or if you are unsure of anything.

What do you need to do as an employee?

If you are eligible to receive SG contributions as an employee, the following could be useful to consider:

- Check your payslips to make sure you are being paid at the new SG rate of 10% starting from 1 July 2021.

- Review your superannuation fund statement to ensure the correct SG amount has been paid to your superannuation fund.

- If you believe your employer is not paying you correctly, discuss it with them directly so that it can be rectified.

Sorry, comments are closed for this post.