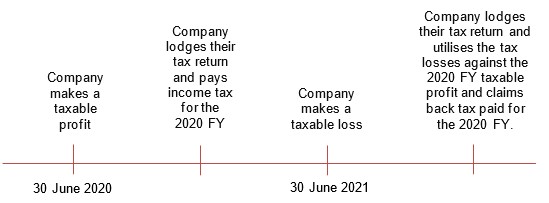

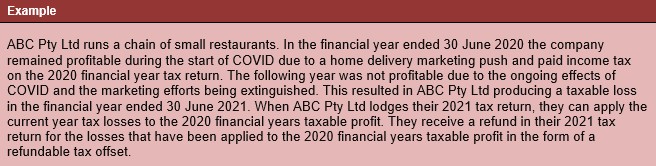

In October 2020, the Government introduced the loss carry-back regime. It will allow companies that have previously incurred an income tax liability in a relevant year to claim current year losses against the prior year’s tax liability. The refund of prior year’s tax will be received in the form of a refundable tax offset when their current year’s tax return is lodged.

What are the relevant periods?

The Loss Carry-back measures are available for the following financial years:

- 2019-20

- 2020-21

- 2021-22

This means that a company can claim back income tax paid from the 2018-19 financial year up to the 2020-21 financial year in the following years tax return if a taxable loss is incurred.

Who is eligible to access the loss carry-back regime?

To access the loss carry-back regime you must:

- Be a company, corporate limited partnership, or a public trading trust.

- Have an aggregated turnover that is under $5 billion.

- Be able to utilise the losses under the loss integrity rules.

- Have lodged an income tax return for the current year and each of the previous 5 years. If the company was incorporated within the previous 5 years, they are still able to satisfy this requirement if tax returns have been lodged for all years following incorporation up to the current year.

How does the loss carry back regime work?

Note: This is only available for tax losses – capital losses do not apply to this regime.

By utilising the current year tax losses against a prior year’s taxable profit, the company can claim back tax that was previously paid in relation to the prior years taxable profit. This is done in the form of a refundable tax offset in the current years tax return.

Restrictions to the loss carry back regime

To maintain the integrity of other areas of the tax law, the below restrictions have been imposed on the availability to claim the loss carry back tax offset.

- The tax offset is only available if the loss integrity tests are satisfied, these include:

- Continuity of Ownership Test (COT) – The ownership of the company does not have a 50% or more change.

- Similar Business Test (SBT) – The business continues to operate the same or similar business.

The above is a general overview of the loss integrity rules and does not go into the specific requirements of each test.

- The tax offset is limited to the year-end balance of the companies franking account (an “account” that tracks how much tax is available to distribute in the form of a franked dividend). This is in place to ensure that the franking account does not go into a negative balance.

When can the tax offset be claimed?

The tax offset is available to be claimed in the 2021 and 2022 tax returns. When doing so, you will be able to claim a tax loss made in the 2020, 2021, and 2022 financial years that is being applied to the 2019, 2020, and 2021 financial years taxable profit.

Claiming the tax offset is optional and should be considered carefully to ensure it does not have any negative implications for your company. Catalyst Financial can assist with making this determination when preparing your companies tax returns for the relevant years.

Sorry, comments are closed for this post.