We all know SMSF rules and compliance requirements can be complex and onerous, with potentially dire consequences, so it’s absolutely critical to be aware of unexpected areas that may cause your SMSF to breach these rules.

“Non-arm’s length income” (NALI) is one of the many areas of SMSF compliance that can catch out unsuspecting and well-meaning members, resulting in income being taxed at a whopping 45%. Breaches can take many forms (some of which may surprise you!) and with amendments made last year to further extend the rules, it is more important than ever to understand what NALI is and ensure your SMSF is not breaching the rules unknowingly.

The concept of Non-arm’s length income (NALI)

Because superannuation funds are taxed at the concessional rate of 15%, the NALI provisions acknowledge that there is incentive to artificially inflate earnings within a superfund through non-arm’s length dealings to capitalise on the lower tax rate.

Consequences of NALI

The NALI provisions penalise a fund for entering into such arrangements by making a portion of the fund’s income subject to tax at the much higher rate of 45%.

The amount of income subject to tax at this higher rate is the NALI amount, less any deductions attributable to that income.

Importantly, income that is NALI cannot be exempt current pension income (income from assets supporting member pensions), which would normally be tax free. This NALI will still be taxed at 45%.

The previous definition of “non-arm’s length income”

The term “non-arm’s length income” is defined in the Income Tax Assessment Act 1997.

Prior to the recent changes, the term was defined to include income that is earned by the fund where:

- the relevant parties were not dealing with each other at arm’s length; and

- the income amount is more than the amount that the entity might have been expected to derive if those parties had been dealing with each other at arm’s length.

The definition also includes:

- dividends received by the fund from a private company unless the amount is consistent with an arm’s length dealing; and

- trust distributions received by the fund from a trust other than because of a fixed entitlement where all dealings are at arm’s length.

Definition of NALI expanded to consider non-arm’s length expenditure

The definition was amended effective 1 January 2020 (with the changes applying for the 2019 and future income years) to also include income where, in the process of gaining or producing the income:

- the entity incurs a loss, outgoing or expenditure of an amount that is less than the amount that it might have been expected to incur if the parties had been dealing with each other at arm’s length; or

- the entity does not incur a loss, outgoing or expenditure that it might have been expected to incur if the parties had been dealing with each other at arm’s length.

Further, the ATO released a Draft Law Companion Ruling (LCR 2019/D3) to clarify how the new rules would apply in varying circumstances.

It clarifies that non-arm’s length expenditure incurred to acquire an asset (including associated financing costs) will have a sufficient nexus to all income derived by the fund in respect of that asset, including any capital gain derived on the disposal of the asset

Somewhat unexpectedly, the ruling also indicated the ATO’s view that where non-arm’s length expenditure has a sufficient nexus with all of the income derived by a SMSF (for example accounting fees), all income of the fund could be considered to be NALI for the relevant year, and therefore subject to tax at the higher 45% rate.

This is a significant definitional change that results in the NALI provisions having a much broader reach than they did previously.

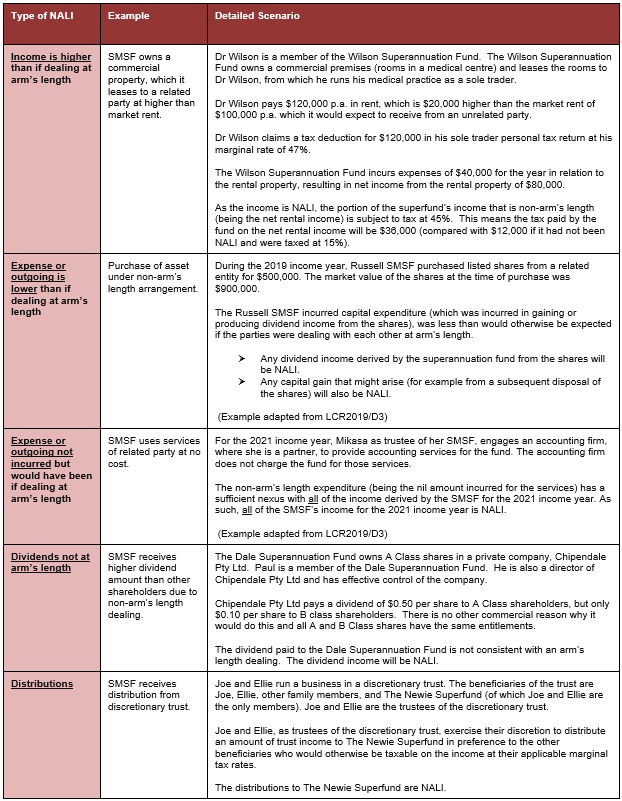

Examples

Below are just some examples of the NALI rules in action to demonstrate the concepts. (This is not an exhaustive list).

What next?

Due to ATO concerns that the legislative change has not been explicitly communicated, a guideline was recently released which provides a transitional compliance approach for complying super funds in relation to certain non-arm’s length expenditure. Broadly, the ATO notes that it will not devote compliance resources to the issue for the 2018-19, 2019-20 and 2020-21 income years where the fund has incurred non-arm’s length expenditure of a general nature that has a sufficient nexus to all income derived by the fund in those respective income years.

Nonetheless, all SMSF trustees should thoroughly review:

- all existing investments to identify any income that could potentially be considered NALI; and

- all outgoings and expenditure (both general and relating to specific investments) to identify any expenditure that could be considered non-arm’s length expenditure.

If any such circumstances are identified, trustees should contact their advisor immediately for further advice.

Not sure if your SMSF is affected by the NALI rules? A Catalyst Financial team member can help you to understand whether NALI applies to your specific circumstances and identify any action to be taken.

Sorry, comments are closed for this post.