So, business is going well and the cash is rolling on in. It’s your business, so you can just take the cash out, right? WRONG!

All too often, we see business owners make the mistake of treating the business’ money as their own.

Business structures can be wonderful vehicles through which to operate your business, but when it comes to taking money out of the business, it is important to remember that unless you are operating as a sole trader, your business entity is separate to you and you must treat its assets (including its cash) as such.

What ways are there to take money out of a business?

There are effectively three ways to take money out of a business:

- Distribute profits;

- Pay wages; or

- Provide a loan.

There can be advantages and disadvantages to each.

Distributing profits

Profits are distributed differently depending on the entity structure:

- Companies – Directors declare a dividend to shareholders.

- Trusts – The trustee resolves to distribute the trust’s income to the unit holders / beneficiaries.

- Partnerships – Partnership profits are distributed to the partners in accordance with the partnership agreement.

Wages

Wages are a simple but effective way of getting money out of your business. Often business-owners don’t stop to reflect how much time and energy they put into their business, but this can add up and be rather substantial when considered in the context of a market salary for a similar role in someone else’s business. Wages are not an option for sole traders and partners in partnerships (as you can’t pay a wage to yourself), but it is possible for these businesses to pay wages to other individuals.

A part from unrelated employees, there may be someone in your family (perhaps your spouse or child) who also does work for the business. Provided the wage is commensurate with their input into the business, there is nothing preventing you from paying a wage to someone in your family.

One thing to consider when deciding to pay wages is that there are a number of on-costs associated with paying wages, including superannuation guarantee, workers compensation and potentially payroll tax.

Loans

Providing a loan can be very simple and in many cases you might not even realise you are doing it! Any time the business provides you with cash or other assets of the business that haven’t been attributed to you via either wages or a distribution, you are effectively taking a loan from the business. People often refer to this as taking “drawings” from the company / trust.

Loans from your business can either be formal (with a loan agreement, set rate of interest and repayments determined in advance) or informal. Many business owners will have loans to/from their business that are informal and, more often than not, interest free.

Loans can be ok, but can also land you in hot water from a tax perspective (see below).

Before going ahead and borrowing money from the business, you should always:

- Check whether your partnership agreement, trust deed, company constitution or shareholders agreement allow you to borrow from the business.

- Talk to your accountant to make sure there are no adverse tax consequences (especially if borrowing a large amount!).

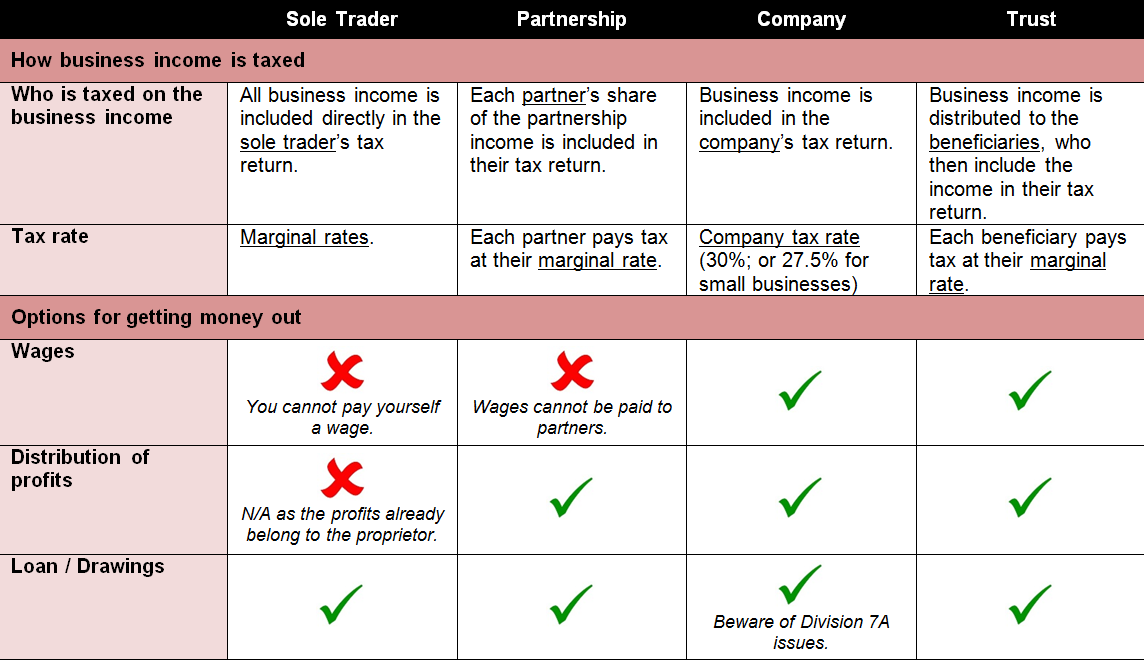

- The following is a summary of how business profits are taxed and what options are available for withdrawing money from a business.

When does a loan become a problem?

You will often hear accountants talk about “debit loans” or “Division 7A”. While it sounds like a whole world of mystery (and it can be when you delve into the nitty gritty of the law), the overarching principle is quite simple.

Any loan from a private company to a shareholder of that company, or any associate of a shareholder of that company, is subject to Division 7A rules. (Associates of a shareholder broadly include spouses and family members, as well as trusts that are controlled by those people).

The Division 7A rules seek to prevent money being taken out of private companies by way of loans or other benefits provided, where it results in an individual or their associate benefiting from the company’s funds without paying tax on the money that has been withdrawn. When taking money out of a company via either wages or dividend, the individual must pay tax on that income at their marginal rate. However, when a loan is provided, the individual is receiving the benefit of those funds without having paid tax on them.

What are the consequences of a Division 7A loan?

If you think of the Australian tax law as operating with carrots and sticks, the Division 7A provisions are a perfect example of the stick! As a hefty disincentive for breaking the rules, the Division 7A provisions operate such that where a private company provides a loan or other benefit to its shareholder or their associates, and certain conditions are not met, the entire value of that loan/benefit is deemed to be an unfranked dividend to the shareholder/associate. This means the shareholder/associate is taxed on the full value of the loan/benefit with no access to franking credits. If you withdrew $100,000 and were already on the top marginal rate, that would be a $47,000 tax bill!

The only way to avoid the loan/benefit being treated as an unfranked dividend is if one of the following occurs by the company’s tax return lodgement date for the year in which the loan was made:

- The loan is re-paid in full; or

- The loan is put under a complying Division 7A loan agreement.

A Division 7A loan agreement is a formal loan agreement with a 7 year or 25 year term (for un-secured and secured loans respectively), where minimum yearly repayments are required (calculated in accordance with the tax law) and interest is calculated using an interest rate determined by the ATO for the purpose of these loans (rate released annually).

Failure to meet the requirements of the Division 7A loan agreement will result in the remaining balance of the loan being treated as an unfranked dividend.

The above is designed to give you a basic understanding of the ways in which money can be taken out of a business. As always, there are numerous exceptions and intricacies in the law, and you should seek professional advice before making any decisions for your business.

Sorry, comments are closed for this post.