Working capital represents the funds / resources available to a business for use in day-to-day operations. It is the lifeblood of every business because it is what enables the business to cover day-to-day costs and, ultimately, keep its doors open. A low level of working capital may result in a business being unable to pay its creditors, or may lead to a low-level of investment in business operations which is likely to result in lost sales opportunities.

Working capital is also a measure of a business’ efficiency and its short-term financial health. Having healthy working capital means the business is able to generate income and collect debtors efficiently, as well as manage inventory and creditors effectively.

Below, we explain:

- What working capital is;

- How to monitor it; and

- Tips for managing it.

How working capital is calculated

Working capital is calculated as:

Current assets are all short-term assets that can reasonably be expected to be converted into cash within one year. These normally include cash, debtors, inventory, prepaid expenses and other liquid assets that can be converted into cash.

Current liabilities are all short-term liabilities that are due to be paid or expended within twelve months. Current liabilities include trade creditors, taxes payable (income tax, GST, PAYG Withholding), superannuation payable, bank overdrafts, short term borrowings, accrued expenses, and any other amounts that may be due to be paid within the 12-month period.

Cash Conversion Cycle

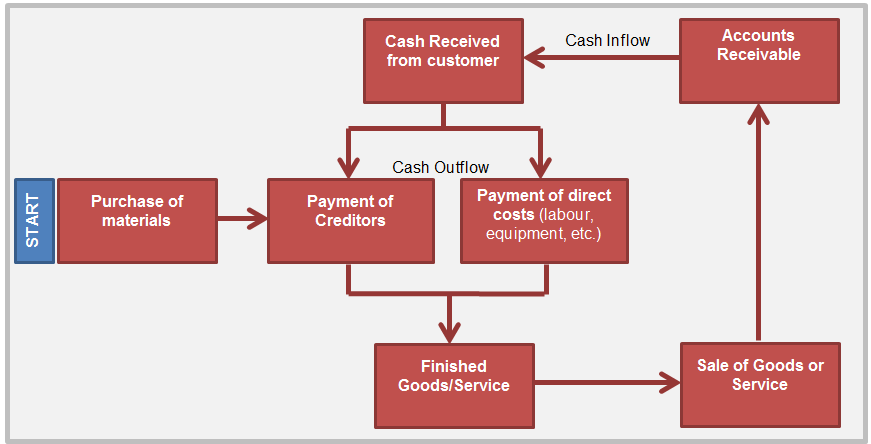

The cash conversion cycle explores the processes around the outflows and inflows of cash, and how long it takes for the cash to cycle from direct expenses to receiving cash from the customer. The diagram below is an example of a cash conversion cycle and demonstrates the need for sufficient working capital in order to fund the next step in the cycle.

Figure: The Cash Conversion Cycle

Components of Working Capital

The three main aspects of working capital to monitor are:

- Inventory / Work in Progress;

- Accounts receivable (debtors); and

- Accounts payable (creditors).

Other accounts such as prepayments, accruals and deposits also affect working capital, but are generally less significant for the purposes of managing it.

Accounts payable

The first step in the cash conversion cycle is generally the purchase of materials (manufacturing), stock (retail / wholesale) or engaging labour (services). The ability to pay suppliers after the supply has been provided means a business can commence the conversion cycle without having to pay for the supply upfront.

The “Creditor days” ratio represents how many days (on average) it takes you to pay your creditors.

Creditor Days is calculated as (average creditors divided by purchases) multiplied by 365.

Taking advantage of your suppliers’ full credit terms means cash is retained in your business for as long as possible and is available to fund day-to-day operations or additional growth.

Monitoring creditor days can help you to identify if your business is breaching any credit terms with suppliers (which can result in penalties or interest charges, or jeopardise your business relationship with them). Conversely, you may identify that you are paying your creditors too early and unnecessarily forgoing the use of the funds with no additional benefit for doing so. Some suppliers may offer discounts for paying early, which may also impact your decision on when to pay them.

To implement changes, ensure you have a good accounting software (such as Xero or MYOB) to keep track of creditors and due dates of invoices. Enter bills as soon as you receive them, and monitor outstanding creditor s at least once a week.

Inventory

Holding the right amount of inventory at any point in time is critical for businesses that sell or manufacture goods. Holding stock means cash is tied up until it can be sold and converted into cash.

Having excessive stock may result in:

- Longer turnover times (from when you buy the stock until it is sold and can be converted into cash);

- Increased risk of obsolescence, damage and theft.

Conversely, having insufficient stock may result in:

- Lost sales opportunities;

- Increased holding costs

- Negative impact on customer relationships if you are seen as unreliable.

Hence, it is important to achieve the right balance.

The “inventory turnover ratio” calculates the number of times in a year your business turns its stock over (i.e. how many times you have gone through a complete cycle of purchasing and selling stock).

Inventory Turnover ratio is calculated as COGS divided by average inventory.

This can also be expressed as inventory turnover days calculated as 365 divided by the inventory turnover ratio.

A high “inventory turnover days” ratio means it is taking a long time to turn stock over, whereas a very low “inventory turnover days” ratio may mean that the business is not holding enough stock to meet demand. Naturally it is important to consider these ratios in the context of your business. It can also be useful to compare your ratios to industry benchmarks and averages as a starting point for analysis.

Work in Progress

For service based businesses, “inventory” comes in the way of work that has been done, but not yet billed. This is known as work in progress (WIP).

WIP can be analysed in a similar way to inventory to determine how efficiently your labour costs (time charge) is converted into sales. High turnover days would indicate delays in getting work completed and billed, whereas an extremely low turnover days would generally indicate excess capacity.

Accounts Receivable

Collection of debtors is the point in the cash conversion cycle where money flows back into the business and creates available funds for future operations.

The “Debtor Turnover Ratio” indicates the efficiency of a business’ collection of funds after invoices have been issued to its customers. It shows how many times on average over a chosen period your debtors are collected. The ratio can also be expressed as “Debtor days”, which reflects the average number of days it takes to receive cash after making a sale.

Debtor Turnover Ratio is calculated as net sales divided by average debtors.

Debtor days is calculated as 365 divided by the debtor turnover ratio.

The higher the ratio (lower for debtors days) the more efficient the businesses is at following up with debtors and getting paid. Too high a debtor turnover ratio could suggest that a company has debt collection policies that are too conservative, and could lose potential customers that seek an industry standard credit terms for payment. At the other end of the spectrum, a debtor turnover ratio that is too low could suggest more effort needs to be placed in debt collection to ensure sufficient funds are available for future operations.

The first step to effective debtor collection is having the right processes and systems in place to empower you. Accounting software products such as Xero allow you to track and view outstanding debtors, as well as provide simple online payment methods to encourage quick and accurate payment, and functionality to send out reminders to customers when invoices are nearly due for payment, or are overdue.

There are also a number of incentives a business can use to prompt debtors to pay their debt, such as early discount payments, reasonable credit terms and interest and penalty charges for late payment.

How to use this knowledge to improve your business!

- Calculate the ratios on a regular basis (by month, quarter, year).

- Look for trends or patterns.

- Where you have observed poor results, try to identify what might have been happening in the business to cause this. Work on ways to improve processes within the business to avoid or minimise the same problems in the future.

- Where good results have been observed, try to identify what the business was doing differently at that time so you can do more of this!

Tips for analysing the numbers

- Always remember to interpret the results in the context of your own business (consider the type of product you are selling, who your customers are, seasonality etc).

- It can also be very useful to compare your results to industry averages / benchmarks.

Understanding your business’ working capital and cash conversion cycle is key to promoting its longevity, as well as improving efficiency to ultimately improve the bottom line and maximise profits.

Sorry, comments are closed for this post.