Do you rent out a part of your home or a holiday home on Airbnb, Stayz or another sharing site? Perhaps you see this as a way of making a little extra income to help the household budget or to save for that holiday. But what you may not be aware of are the long term tax implications of such a move, which may lead to a case of short-term gain causing long-term pain.

These days it seems more and more people are diving head first into the sharing economy by driving Ubers or listing their properties on Airbnb and other home sharing sites. Renting out a part of your home or your whole home while you’re on holidays seems like a great way to make some extra money now, but if you go down this route you must consider what are the tax implications for you now and in the future?

Reporting income

Any income you earn from home sharing regardless of whether it is long-term or short-term is treated as rental income, and must be included in your tax return. Deductions can be claimed against the income and any net profit from the property will be taxed at your marginal rate. If you make a loss from renting out your property, the loss can be used to offset your other income, such as salary, sole trader business income, and other investment income.

Claiming deductions

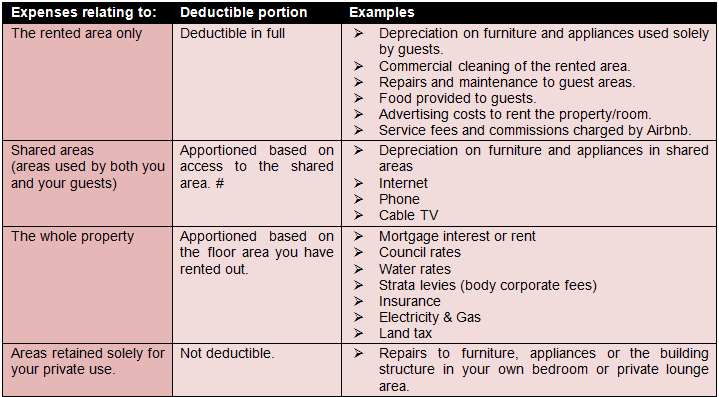

Expenses you incur in relation to the property being rented out are generally deductible.

- Some expenses need to be apportioned based on the tenants access to the area (refer to the table below).

- Expenses are only deductible for the period the room/property is either rented out or available to be rented out.

- If you rent out your property at less than normal commercial rates (for example, to a relative or friend), this may limit your deductions.

# For example, if you and the guests both have equal access to the living room and kitchen, 50% of the expenses relating to those areas would be deductible.

PAYG Income Tax Instalments

Depending on whether your Airbnb property is profitable, as well as what other sources of income and deductions you have, your first tax return that includes your Airbnb income may result in a tax liability. This is because there has been no withholding on that income during the year.

After your return has been lodged, the ATO may issue you with quarterly PAYG Income Tax Instalments, which are effectively prepayments towards your next tax bill. These are intended to ensure you don’t have a large tax bill at the end of the year. The instalment amount is revised each year by the ATO after you lodge your tax return.

Selling your property

Generally, you don’t pay CGT on any gain you make when you sell the home you live in. However, if you have used your home to produce income (such as via Airbnb), you may not be entitled to the full exemption. The portion of your capital gain that relates to the portion of your home rented out will be assessable. The gain is also apportioned to reflect the period of time your home was rented out.

The ATO’s Deputy Commissioner for Small Business, Deborah Jenkins, has said: “Once income is earned from a primary place of residence there are Capital Gains Tax (CGT) implications. It is possible that if a property significantly increases in value, the amount of CGT owed may even be higher than the amount of income received.”

Tips to assist with tax time

- Consult a registered tax agent to clarify your circumstances before you start renting your property.

- Calculate the total floor space of your property.

- Calculate the floor space of the rented out area.

- Record the percentage of access the tenant has to the shared areas.

- Keep records of all property expenses (Examples of expenses are shown in the above table).

Put aside a set percentage of your rental income in a separate bank account towards your future tax bill.

Sorry, comments are closed for this post.