It might seem like a horror movie cliché, a monster that follows you wherever you go, but did you know that your higher education debts under the Higher Education Loan program (HELP), Trade Support Loan (TSL) or the Higher Education Contribution Scheme (HECS) debts follow you wherever you go in the world?

Prior to 2017, individuals could incur these higher education debts and move overseas with no repayment obligations. However, these debts are now required to be repaid regardless of where you are in the world, as long as your worldwide income is over a certain threshold. This applies regardless of whether your debt was incurred before or after 2017.

Who is affected?

Persons who:

- Have an outstanding HELP, TSL or HECS debt incurred at any time; and

- Live overseas OR are overseas for 183 days or more in a 12 month period (whether or not consecutively)

Step One: Notify the ATO that you will be overseas

If you have a higher education debt and plan on going overseas for 183 days or more in any 12 months, you will need to update your contact details and submit an “overseas travel notification”.

This includes for any reason such as holiday, study or work. The 183 days is counted cumulatively and does not have to be taken all at the same time. For example, you could go on a holiday for a few months in one country, come back to Australia for a few months and then travel to another country. As long as it exceeds 183 days in total in any 12 months period you will have to submit an “overseas travel notification”.

Step Two: Report your worldwide income annually

Once you’ve submitted the notification and have moved overseas, or if you’re already living overseas and have a HELP, HECS or TSL debt, the next step is to report your worldwide income to ATO every year. Your reporting obligations depend on whether your worldwide income is greater or less than 25% of the “repayment income threshhold”. The repayment income threshhold is AUD 51,957 for the 2018-19 year.

If your worldwide income is below 25% of the repayment income threshhold (ie. AUD 12,989 for 2018-19 year), you do not have to report your worldwide income but you will need to lodge a “non-lodgement advice form” to notify the ATO of your situation. Note that this is different to lodging a normal “No return necessary”.

If your worldwide income is over 25% of the repayment income threshhold (ie. AUD 12,989 for 2018-19 year), you must report your worldwide income in an Australian tax return. Lodgements are usually due by 31 October each year, but it may be extended if you use a tax agent.

Non-residents can choose from three assessment methods to calculate their worldwide income for HELP/TSL/HECS repayment purposes: the self-assessment method, the overseas assessment method, or the comprehensive tax-based assessment method.

Step Three: Making repayments

You will only need to make repayments if your worldwide income exceeds the repayment income threshhold (AUD 51,957 for 2018-19 year).

The repayment rate depends on how much worldwide income you earn and range from 4% to 8%. The repayment amount will be calculated and assessed by the ATO when you submit your Australian tax return.

If it all seems too complicated, another option is to reduce your debt before you head overseas by making voluntary repayments.

If you find yourself in financial hardship while overseas and cannot afford the compulsory repayment even though you earn above the minimum repayment threshold, you can apply to the ATO to defer the payment.

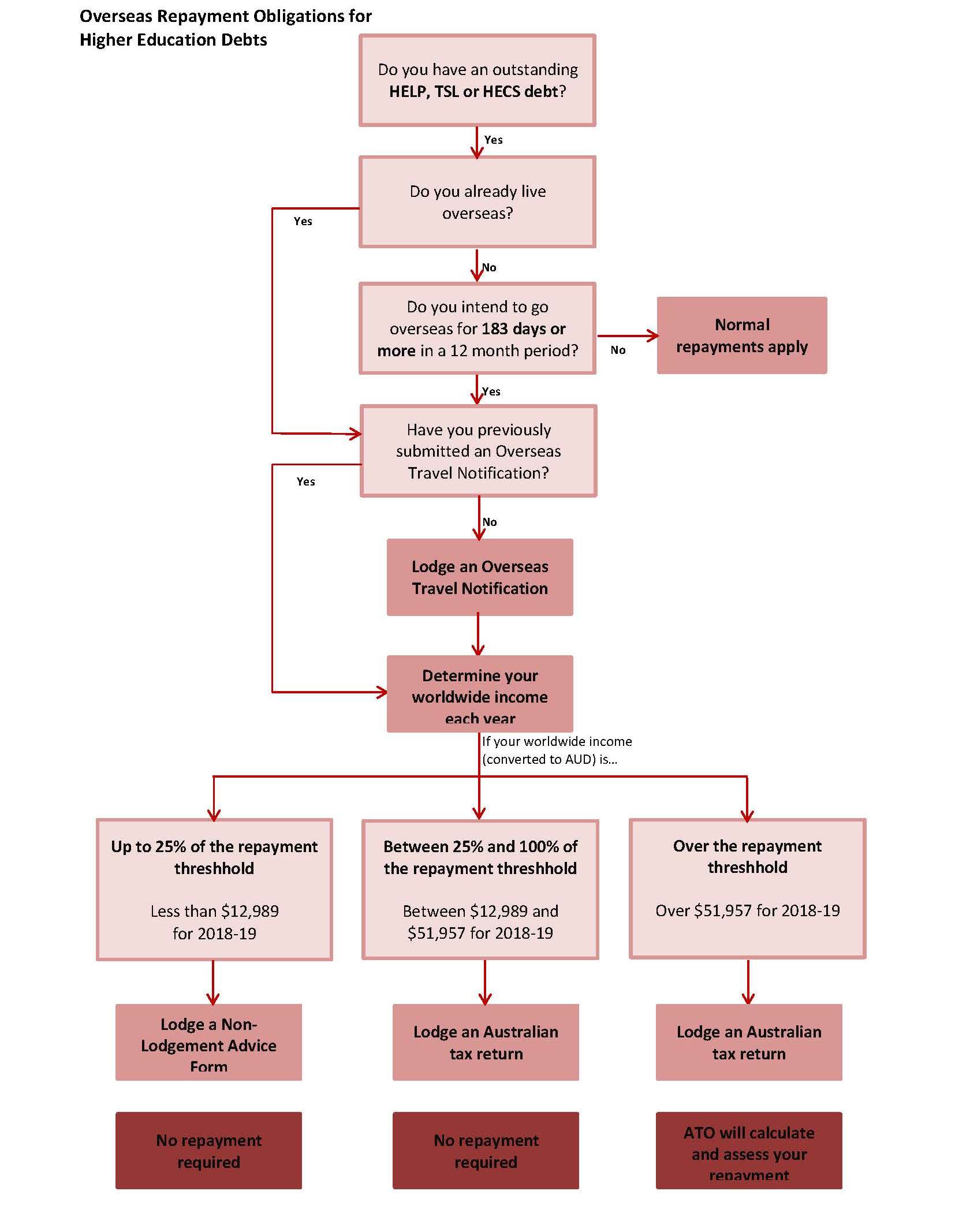

The following is a useful flowchart to assist in determining your repayment obligations.

Need guidance?

If you’re going overseas, or are already overseas, and you have a higher education debt, we can help you get your house in order and lodge your returns with the ATO while you’re away.

Sorry, comments are closed for this post.