If you are an employer, the way you report payments such as salaries and wages, pay as you go (PAYG) withholding and superannuation is changing. The ATO’s new rules require employers to report these payments directly from their payroll solution in real-time, at the same time as they pay their employees. This is known as Single Touch Payroll (STP) and is intended to simplify business reporting obligations. It comes into effect on 1 July 2018 or 1 July 2019, depending on the size of your business. Businesses need to be ready for this change and how will it affect their payroll processes.

The introduction of STP is in line with the Government’s “digitisation agenda”, to make reporting more streamlined, but many small businesses will feel an extra compliance burden. Those who work in remote areas of Australia may be at a disadvantage as STP reporting will require a strong internet connection.

The Institute of Public Accountants (IPA) chief executive officer, Andrew Conway has said: “While initially STP delivers little benefit to small business, we acknowledge that other benefits exist such as transparency over superannuation guarantee payments”. The IPA also acknowledged that for small and micro businesses (those who employ less than five people), implementing STP by the deadline will take considerable incentive and support.

How will this change affect you as an employer?

The change to STP means that employers won’t need to complete payment summaries at the end of the year as these will have been reported in real time throughout the year. If you have a payroll solution (software that you use in order to pay employees), you will need to update this or make sure it is updated by your service provider. If you do not have a payroll solution, you can speak to us about how to find the best solution for your business. The first 12 months of STP will be considered to be a transition period, during which time you could be exempt from an administrative penalty for failing to report on time. There are other exemptions, including if you operate in an area with an unreliable internet connection or you are classed as a substantial employer for only a short period during the year (for example, if your employees are seasonal).

What does it mean for employees?

With the move to STP, employees will be able to log on and check that they are being paid the correct amount for their superannuation contributions. This creates a higher level of transparency between employees and employers.

What is the timeframe?

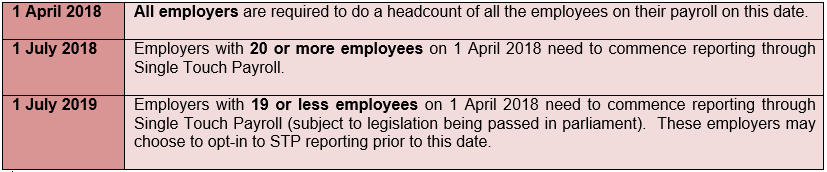

The deadline for adopting STP depends on whether you are considered to be a “substantial employer”. To determine this, employers are required to do a headcount of all the employees they have on their payroll on 1 April 2018. Employers with 20 or more employees on that date are “substantial employers”.

Taking a correct headcount

When undertaking the headcount, you need to include:

- full-time employees

- part-time employees

- casual employees who are on your payroll on 1 April and worked any time during March

- employees based overseas

- any employee absent or on leave (paid or unpaid)

- seasonal employees (staff who are engaged short term to meet a regular peak workload, for example, harvest workers)

Do not include:

- any employees who ceased work before 1 April

- casual employees who did not work in March

- independent contractors

- staff provided by a third-party labour hire organisation

- company directors

- office holders

- religious practitioners

The headcount is not just your full-time equivalent (FTE) number on the count date.

If you are part of a company group, the total number of employees employed by all member companies of the wholly-owned group must be included.

What if you run a small business?

Beyond the 1 July 2019 implementation date businesses are not exempt from the reporting requirements based on size. If you are a small business that does not use digital software for payroll, you will need to adopt new technology in preparation for STP.

Can you request a deferral?

If your business is not ready to meet the STP reporting obligations by your relevant start date, you could qualify for a deferral or exemption. Deferrals and exemptions are granted only where there are circumstances beyond your control that prevent you from complying. A request needs to be submitted prior to your relevant start date.

Contact us to discuss the changes to payroll and what you need to do to make the transition seamless for your business.

Sorry, comments are closed for this post.