Businesses face many different risks on a daily basis. It is prudent for businesses to mitigate these risks through various avenues to reduce the impact on the business if something unexpected happens. One way to mitigate risks is by taking out insurance to compensate the business for any losses or damages that it may suffer in the instance of such unexpected situations.

There are many different types of insurances available to businesses (some optional, some compulsory), which can often be bundled into packages with one premium being paid for multiple types of insurance.

Types of insurance

What combination of insurance policies is required is unique to each business – there is no “one size fits all” package. It is important to ensure that your business is covered for the specific risks it faces, and that an appropriate level of coverage is taken out.

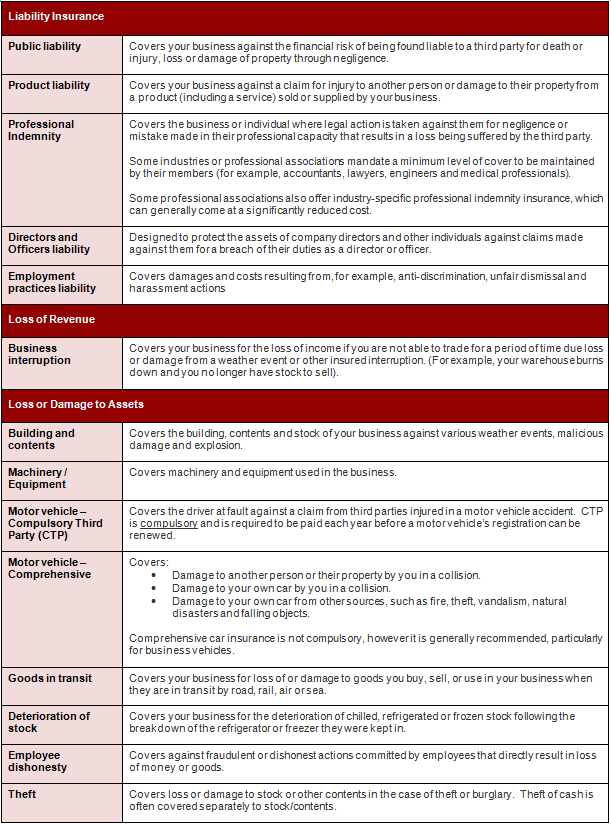

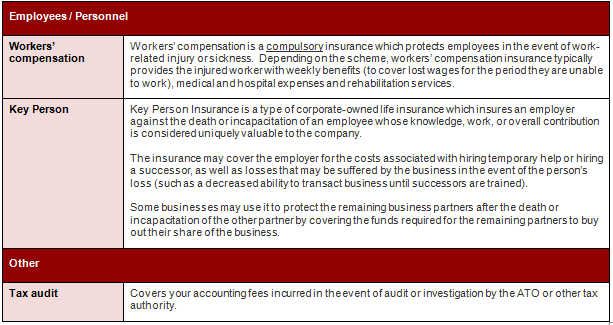

The main things covered by business insurances tend to fit into the following main categories:

- Liability;

- Loss of revenue;

- Loss of or damage to business assets; and

- Employees / Personnel.

Below is a brief description of various insurance products available in each of the above categories.

Tips

- Take half an hour to sit down and brainstorm a list of risks – things that could put your business’ assets, revenue, or people (both directors and staff) in jeopardy. Consider what would happen if event came to fruition, how your business would cope and what support or financial resources you would need. This is a good starting point to consider what types of insurance your business might need.

- Check your policies annually. Consider:

- Whether there have been any changes to policy inclusions/exclusions;

- Whether the insurance you have selected still matches your business’ risks;

- Whether the amount of coverage is adequate, taking into account growth in your business, newly acquired assets and changes in inventory.

- Read the PDS – it sounds like a bore, but it’s important that you understand what your business is actually covered for and can make a huge difference in the long run.

If anything does happen, ensure you keep detailed records and contact your insurer as soon as possible to ensure you have the best chance of a successful claim. ·

Sorry, comments are closed for this post.